Money Research Collective’s editorial team solely created this content. Opinions are their own, but compensation and in-depth research determine where and how companies may appear. Many featured companies advertise with us. How we make money.

Election Day 2024: How Harris and Trump Compare on 7 Key Money Issues

By Julia Glum, Pete Grieve MONEY RESEARCH COLLECTIVE

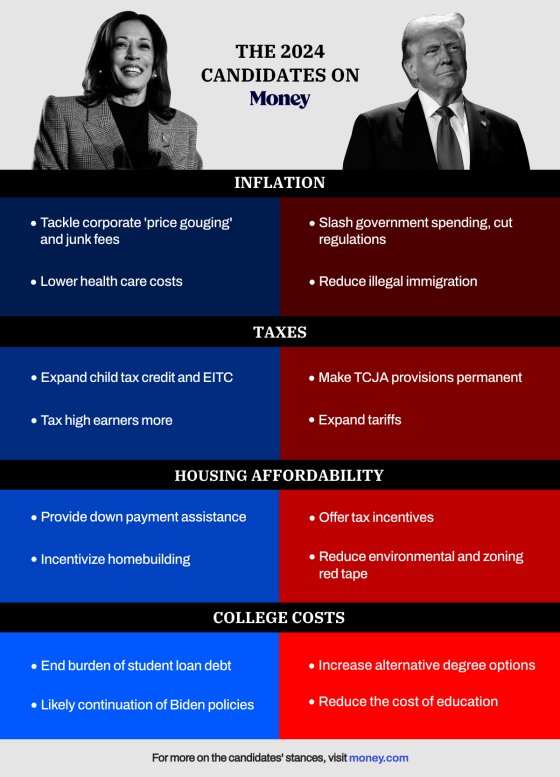

Here are Kamala Harris’ and Donald Trump’s views on seven crucial financial issues, from inflation and taxes to Social Security and housing.

Americans have money on their minds as they head to the polls to cast ballots in the 2024 general election.

Financial issues have consistently topped lists of issues voters care about this year, leading former President Donald Trump and current Vice President Kamala Harris to double down on their plans to lower the cost of living, improve job security and make housing affordable, among other things.

Although both candidates have served in the White House, they had very different experiences. While Trump was tasked with guiding the country through the early stages of the COVID-19 pandemic, which saw a sharp increase in unemployment and a severe recession, Harris (under President Joe Biden) had to navigate the economic recovery and historic spike in inflation that followed.

Now, with the economy mostly healthy and inflation near normal, the 47th president must establish policies that will ensure growth and reduce the financial pressures on everyday Americans.

Here are quick summaries of Harris’ and Trump’s stances on seven important issues that could impact your wallet, plus links to our in-depth reporting on those topics.

Inflation

Harris: Bringing down the cost of living is at the top of Harris’ to-do list if elected. After peaking above 9% in 2022, the annual inflation rate is down to 2.4% — roughly where it should be, according to the consumer price index. The challenge ahead will be to avoid another bout of inflation during a period likely to see multiple interest rate cuts. Harris’ plans to address further increases in the cost of living include tackling corporate “price gouging” and pushing for lower health care and drug costs. She would also continue the Biden administration’s efforts to eliminate junk fees.

Trump: By the raw numbers during their terms, Trump has a stronger record on inflation, and that’s what he’s running on. He has a five-pronged platform to “defeat” inflation going forward, featuring measures to increase domestic energy production, reduce government spending and stop illegal immigration (which he blames for higher costs of goods and services like housing). The former president is also promising to provide relief for Americans to cope with the higher prices he blames on Biden and Harris.

Read more:

- Harris vs. Trump on Inflation: How Each Candidate Plans to Lower Prices

- Will Inflation Be Worse Under Trump or Harris? Here’s What Economists Say

- How Bad Is Inflation, Really? A Global and Historical Analysis

Taxes

Harris: The vice president says she hopes to give tax cuts to working and middle-class Americans, which she intends to do by expanding the child tax credit and earned income tax credit. (She has also proposed several housing-related tax credits aimed at improving affordability for buyers and renters.) While Harris aims to tax high earners more, she says no one earning under $400,000 a year will have to pay more in taxes.

Trump: Trump’s website says he plans to enact “large tax cuts for workers,” a proposal that centers around making permanent many provisions of the Tax Cuts and Jobs Act he signed while in office. The other major component of Trump’s tax plan involves enacting tariffs of 20% on goods from most other countries (and up to 60% on those from China). He has also proposed eliminating taxes on tips and overtime wages.

Read more:

- Harris vs. Trump: How Could Your Tax Bill Change Under Each Candidate?

- Trump Wants to Give Americans With Car Loans a New Tax Break

- How Trump’s Plan to End Taxes on Social Security Would Actually Work

Housing costs/affordability

Harris: Increased home prices and still-elevated mortgage rates have made the dream of homeownership feel much less attainable for millions of Americans. Harris wants to create a $25,000 down payment assistance program for would-be buyers to reduce barriers. She also says her ideas for incentivizing homebuilding through the tax code could lead to the construction of 3 million homes over the next four years, which would help restore balance to the housing market and promote affordability.

Trump: To lower housing costs, Trump supports removing environmental and zoning regulations that stand in the way of homebuilding. He contrasts the low mortgage rates when he left office to the current average of about 6.7% for 30-year fixed-rate mortgages. If the next president can keep inflation in check, homebuyers may finally get access to lower mortgage rates, but there’s no guarantee that Trump would be more successful than Harris in this regard.

Read more:

- Harris vs. Trump on Housing: Each Candidate’s Plan to Lower Costs for Homebuyers and Renters

- The Typical Down Payment on a Home Has Jumped 15% Since Last Year

- A Record Number of Americans Are Spending More on Housing Than They Can Afford

Social Security

Harris: While both candidates say they’ll protect Social Security and are promising no cuts to current recipients’ benefits, they have different visions for what to do with the program, which is facing a looming funding shortfall. Harris is calling for the rich to “pay their fair share” to ensure full benefits can be paid to current and future retirees. Many Democrats support increasing payroll taxes on high earners, but Harris would oppose any tax hikes on individuals earning less than $400,000 per year.

Trump: To support older adults on fixed incomes struggling with higher everyday costs, Trump proposes eliminating federal taxes on Social Security benefits. Unlike some Republicans in Congress, he opposes increasing the retirement age. Trump’s plan lacks details when it comes to funding the Social Security program, but he says raising taxes on working Americans isn’t necessary because there are “so many different ways to make money.”

Read more:

- Harris vs. Trump on Retirement: How They Stack Up on Social Security, Medicare and More

- 5 Proposals to ‘Fix’ Social Security — and How They Could Affect Your Benefits

- Democrats and Republicans Actually Agree on These Ideas to Fund Social Security

Stock market

Harris: The stock market, as measured by the S&P 500 index, has gained over 50% since January 2021, more than recovering from pandemic-era declines and reaching new record highs. While it’s difficult to forecast how markets will perform after an election, analysts say certain sectors like tech may benefit from a Harris win. The CHIPS Act of 2022, for example, has boosted the tech industry, while Trump’s desire to crack down on big tech monopolies is seen as a threat to stock performance. Investors should also be aware that Harris wants to increase the highest long-term capital gains tax rate to 28%.

Trump: Tax cuts and low interest rates during Trump’s presidency helped the stock market soar over 60%. While many tech donors are hoping for Harris, other parts of the market, like the financial sector (where donors favor Trump), could see higher returns if the former president is re-elected. Trump supports lower corporate tax rates and reducing regulations that he says are slowing economic growth. He also promises to “drill, baby, drill” and would roll back environmental policies, potentially favoring energy stocks.

Read more:

- Trump vs. Harris: How Will the Election Affect the Stock Market?

- Will the S&P 500 Reward Investors This Year by Hitting 6,000?

- Should Investors Brace for More Volatility?

College costs

Harris: Harris’ website touts her record on helping increase Pell Grants for low-income students and secure investments in historically Black colleges and universities, Hispanic-serving institutions and tribal colleges. The website says she plans to “continue working to end the unreasonable burden of student loan debt” without providing further details — or comment on the Biden administration’s student loan forgiveness proposals currently stuck in the courts.

Trump: In the Republican platform, the former president says he supports reducing the cost of education and creating “drastically more affordable alternatives to a traditional four-year college degree.” Trump has cast the Biden administration’s repeated attempts to secure widespread student loan forgiveness as publicity stunts and predicted they will get “rebuked.” But executive action on student debt, as Biden attempted with student loan forgiveness, is a move Trump is familiar with: He was the one who first paused federal student loan payments during the pandemic.

Read more:

- Harris vs. Trump on Student Loan Forgiveness: Here’s Where the Candidates Stand

- Biden Tries Again for Student Loan Forgiveness With a New Plan Targeting 8 Million Borrowers

- An ‘Affordable’ College Degree Now Means Not Going Into Debt, According to Parents

Crypto

Harris: The vice president’s economic policy book does not name-check crypto, though it does mention her intent to “encourage innovative technologies like AI and digital assets.” The most specific plans Harris has outlined for crypto are in her agenda to deliver for Black men, which includes plans to back a regulatory framework for crypto and other digital assets “so Black men who invest in and own these assets are protected.”

Trump: The Republican nominee — who previously labeled crypto a scam — spent much of his campaign courting investors with his plans to “end Democrats’ unlawful and un-American crypto crackdown,” per his platform. His stated priorities include opposing the development of a Central Bank Digital Currency (CBDC), protecting the right to mine bitcoin and making sure folks can have full control over their digital assets. Trump himself holds about $6.7 million of crypto, has his own token and supports firing Securities and Exchange Commission Chair Gary Gensler, who has recently cracked down on crypto.

Read more:

- Election 2024: How Trump Set Himself Apart From Harris on Crypto

- The Number of Bitcoin Millionaires Doubled in the Last Year

- Crypto Crackdown: What Was in Biden’s 2022 Plan for Regulations?

More from Money:

Employers in These 21 States Must Give You Paid Time Off to Vote

Fact-Checking Financial Claims From the Trump-Harris Presidential Debate

How Rich Are Donald Trump and Kamala Harris? Inside the Candidates’ Personal Finances

Julia Glum is Money's news editor, keeping her finger on the pulse of financial trends that affect Americans' wallets. She also writes Dollar Scholar, a weekly newsletter that teaches young adults how to navigate the messy world of money. A 2014 graduate of the University of Florida's journalism school, she previously covered breaking news, politics and education at Newsweek and International Business Times. Julia joined Money in 2018; during her time as a reporter, she wrote frequently about Amazon, passive income, stimulus checks and creative ways people make money online (think: Vine compilations, Cash App Friday and Facebook gift groups). As an editor, she oversees Money’s tax coverage, which includes extensive reporting on tax credits, year-to-year policy changes, tax refunds and the IRS’s ongoing efforts to modernize. For several years, Julia has assisted with Money’s annual Best Colleges rating and Best Places to Live rankings. Recently, she also led Money’s 50th anniversary celebrations, producing the Money Classic newsletter and rolling out Changemakers, a project profiling 50 innovators working to revolutionize personal finance. Julia has interviewed National Taxpayer Advocate Erin Collins, actor Danny Devito, Nobel Prize-winning economist Robert Shiller, rapper Killer Mike, real estate guru Ryan Serhant and many others. Her work has been cited or otherwise shared by the New York Times, Washington Post, Vox, theSkimm, Mashable, CNBC and POLITICO. She’s appeared on Good Morning America, CBS News, PIX11, WGN, the Mountain West News Bureau and more. Julia is based in New York City. You can find her at juliaglum.com.

Pete Grieve is a New York-based reporter who covers personal finance news. At Money, Pete covers trending stories that affect Americans’ wallets on topics including car buying, insurance, housing, credit cards, retirement and taxes. He studied political science and photography at the University of Chicago, where he was editor-in-chief of The Chicago Maroon. Pete began his career as a professional journalist in 2019. Prior to joining Money, he was a health reporter for Spectrum News in Ohio, where he wrote digital stories and appeared on TV to provide coverage to a statewide audience. He has also written for the San Francisco Chronicle, the Chicago Sun-Times and CNN Politics. Pete received extensive journalism training through Report for America, a nonprofit organization that places reporters in newsrooms to cover underreported issues and communities, and he attended the annual Investigative Reporters and Editors conference in 2021. Pete has discussed his reporting in interviews with outlets including the Columbia Journalism Review and WBEZ (Chicago's NPR station). He’s been a panelist at the Chicago Headline Club’s FOIA Fest and he received the Institute on Political Journalism’s $2,500 Award for Excellence in Collegiate Reporting in 2017. An essay he wrote for Grey City magazine was published in a 2020 book, Remembering J. Z. Smith: A Career and its Consequence.